lubbock property tax office

916 Main Street Suite 102. The Lubbock County Assessors Office located in Lubbock Texas determines the value of all taxable property in Lubbock County TX.

Looking for the best property tax reduction consultant in Lubbock County Texas to help you with property tax appeal.

. Current assessments and tax bills for individual properties can be see here. Most businesses can generally expect their property tax rate to be between 196 and 215 per 100 valuation depending on the location of the operation. 806 775 1344 Phone 806 775 1551Fax The Lubbock County Tax Assessors Office is located in Lubbock Texas.

916 Main St Ste 102 Lubbock TX 79401-3412. Tim Radloff is the Chief AppraiserAdministrator and he can be reached at 806-762-5000 or by email. The mission of the Lubbock Central Appraisal District is to serve the property owners and taxing units of Lubbock County by providing accurate timely appraisals of all taxable property at the most cost effective level possible.

As highly respected unbiased third-party specialists in property tax consulting management valuations and appeals our clients depend on us to ensure their tax burdens are reasonable. Current assessments and tax bills for individual properties can be see here. Lubbock County Appraisal District makes no warranty or guarantee concerning the accuracy or reliability of the content at this site or at other sites to which we link.

Whether you are already a resident or just considering moving to Lubbock to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Lubbock County Property Tax Assessor The Lubbock County Tax Assessor is responsible for assessing the fair market value of properties within Lubbock County and determining the property tax rate that will apply. Welcome to Lubbock County Tax Office.

Current Property and Tax rate worksheets are provided on the Lubbock County Appraisal District LCAD website. Learn all about Lubbock County real estate tax. 916 Main St Ste 102 Lubbock TX 79401-3412.

Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property. Government Offices County Parish Government. Property assessments performed by the Assessor are used to determine.

You can call the Lubbock County Tax Assessors Office for assistance at 806-775-1344. Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property. At the Lubbock County Tax Offices we take care of all your motor vehicle needs including registration titles permits and more.

3805 W Alabama St 8106 Houston. Get driving directions to this office. Lubbock County Assessors Office Services.

Lubbock Texas 79401-3412 Street Address 916 Main St Suite 102 Lubbock Texas 79401-3412 Collecting Unit This tax office does not collect property taxes. Whether you are already a resident or just considering moving to Lubbock County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. LCAD provides services to both property owners and the taxing units within its jurisdiction.

LCAD exists for the purpose of providing services to the property owners and taxing units within our jurisdiction. 2109 Avenue Q Lubbock TX 79411. The Lubbock County Assessor located in Lubbock Texas determines the value of all taxable property in Lubbock County TX.

Choose Your Language - Lubbock_County_Tax_Office - QLess Kiosk. Browse HouseCashins directory of 68 Lubbock County top tax advisors and easily inquire online about their property tax protest consulting services. 916 Main Street Suite 102.

Lubbock County property owners have recently received or will soon receive their annual property appraisal. See reviews photos directions phone numbers and more for Property Tax Office locations in Lubbock TX. I had an account with them for 3 months payments were on time and had service shut off due to moving.

The Tax Assessors office can also provide property tax history or property tax records for a property. If you find yourself needing help paying your property taxes or have any questions regarding property taxes feel free to give us a call at 866-PROP-TAX and one of our certified loan officers will be happy to assist you. Learn all about Lubbock real estate tax.

Property assessments performed by the Assessor are. In Lubbock the taxing districts include the city county various school districts and several other taxing authorities. Please call the assessors office in Lubbock before you send documents or if you.

Additionally below you. We provide the most extensive nationwide property tax services representing a broad range of property types unrivaled in the. These property tax records are excellent sources of.

Now 6 months later after I had already. Please CHECK COUNTY OFFICE availability. This County Tax Office works in partnership with our Vehicle Titles and Registration Division.

Box 10536 Lubbock TX 79408-3536. There are 2 assessor offices in lubbock texas serving a population of 247323 people in an. Weve made many property tax loans to property owners in Lubbock County Texas.

Lubbock County property tax appraisals see median 16 percent increase over last year. The Lubbock Central Appraisal District makes no warranties or representations whatsoever regarding the quality content completeness accuracy or adequacy of such information and. The median property tax on a 10310000 house is 180425 in lubbock county.

If you have documents to send you can fax them to the Lubbock County assessors office at 806-775-1551. The Lubbock County Tax Assessor is the local official who is responsible for assessing the taxable value of all. Remember to have your propertys Tax ID Number or Parcel Number available when you call.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Lubbock County Tax Appraisers office.

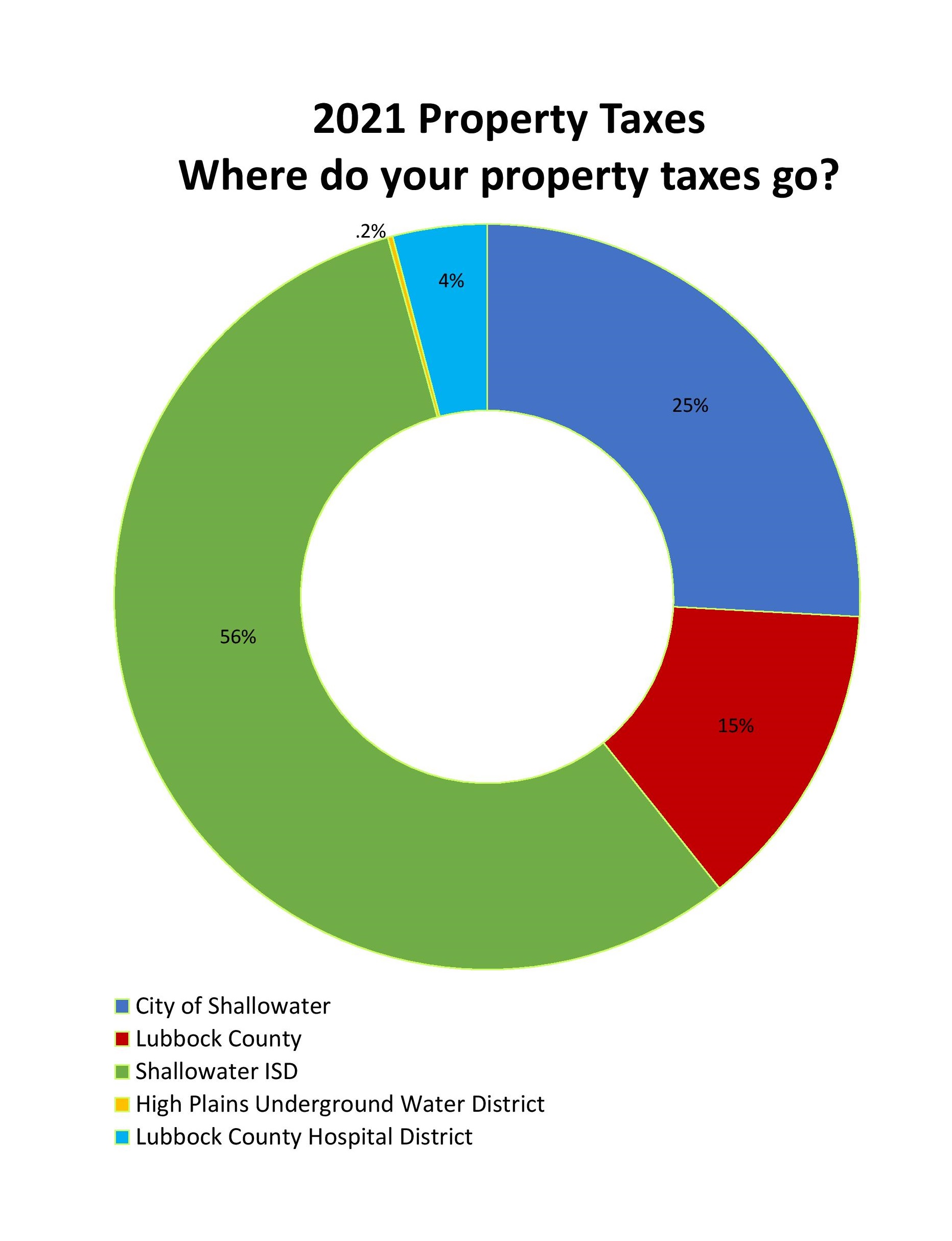

Property Taxes Shallowater Texas

/cloudfront-us-east-1.images.arcpublishing.com/gray/4SSCUWSBWNG33MLWWCYVITRC7E.png)

Lubbock County Sheriff S Office Asking Voters To Raise Property Tax To Pay Deputies More

Flip It Good Top 10 Home Flipping Hotbeds Where Profits Are Through The Roof Diy Remodel Home Repair Home Repair Services

How Long Can You Go Without Paying Property Taxes In Texas A Guide To How Long Property Taxes Can Go Unpaid In Texas Before For Foreclosure Tax Ease

Laredo A Book Store Project Forces St Peter S Historic District Residents To Grapple With Change Laredo Bookstore Historical

Lcad Says Covid 19 Will Not Impact Property Values This Year

Houston Housing Authority Partners With California Developer On Two Multifamily Projects Green Oaks California House Styles

/cloudfront-us-east-1.images.arcpublishing.com/gray/XXHVP63JSFD5JFPURNXGP5LSF4.jpg)

Lubbock Homeowners May See Property Tax Increase This Year

Upstairs At The Mansion And A Post On Instagram 2011 12 Tour Travel Field Office Big Bend Texas Photography Dust Bowl

If You Never Saw The Floor Plan To This Amazing One Story Modern Farmhouse Leave A Comm Modern Brick House Modern Farmhouse Exterior Modern Farmhouse Floorplan

Paul Ardaji Sr Best Thoughts Land Business Property Advancement Good Thoughts Thoughts Business

Spares N Repairs Stock The Leading Brands Of Dishwasher Spare Parts In Uk We Offer The Best Quality Spare Parts Appliance Repair Repair Washing Machine Repair

How Long Can You Go Without Paying Property Taxes In Texas A Guide To How Long Property Taxes Can Go Unpaid In Texas Before For Foreclosure Tax Ease

Paul Ardaji Sr Real Estate Development Strategies Getting Into Real Estate Real Estate Agent Real Estate Investing

I Like This Desk Mudroom Setup I Would Want Some Kinds Of Organizer Built Into The Desk Too Home Kitchen Cabinets Home And Family

Dan Biase And Juniper Home Company Are Excited To Present Their 2015 Parade Home In Fox Ridge With A Cr Timeless Architecture Juniper Home Craftsman Bungalows

/cloudfront-us-east-1.images.arcpublishing.com/gray/XXHVP63JSFD5JFPURNXGP5LSF4.jpg)

Lubbock Homeowners May See Property Tax Increase This Year

Taco Tuesday Taco Tuesday Tacos Tuesday

Voters To Decide Whether Lubbock County Can Raise Property Tax Rate