september child tax credit payment less than expected

The third payment went out on September 17 We apologize The IRS said. If your tax return was recently processed and your income increased substantially from 2019 to 2020 that could be why you received less than the full amount for your September payment.

/cdn.vox-cdn.com/uploads/chorus_asset/file/23423371/GettyImages_1328589075.jpg)

Will There Be An Expanded Child Tax Credit In 2022 Vox

The Internal Revenue Service.

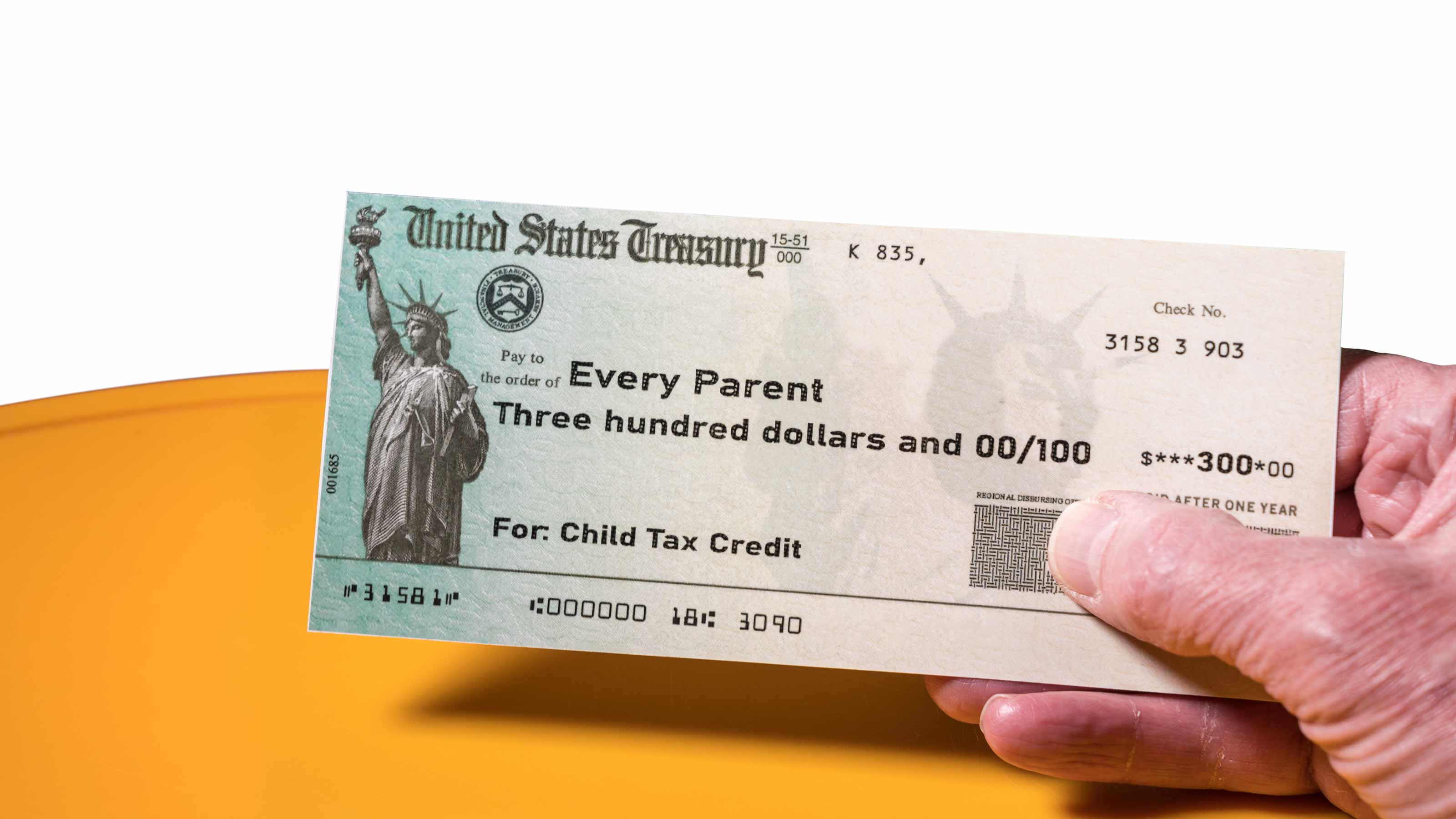

. The new monthly child tax credit payments the IRS has been sending out since July are up to 300 per eligible child but thats only if your annual income isnt over certain. The new monthly child tax credit payments the IRS has been sending out since July are up to 300 per eligible child but thats only if your annual income isnt over certain limits. We know people depend on receiving these payments on time and we apologize for the delay.

The good news is that in most cases the overpayments arent going to make a huge dent in the Child Tax Credit checks. If your September child tax. The agency said that less.

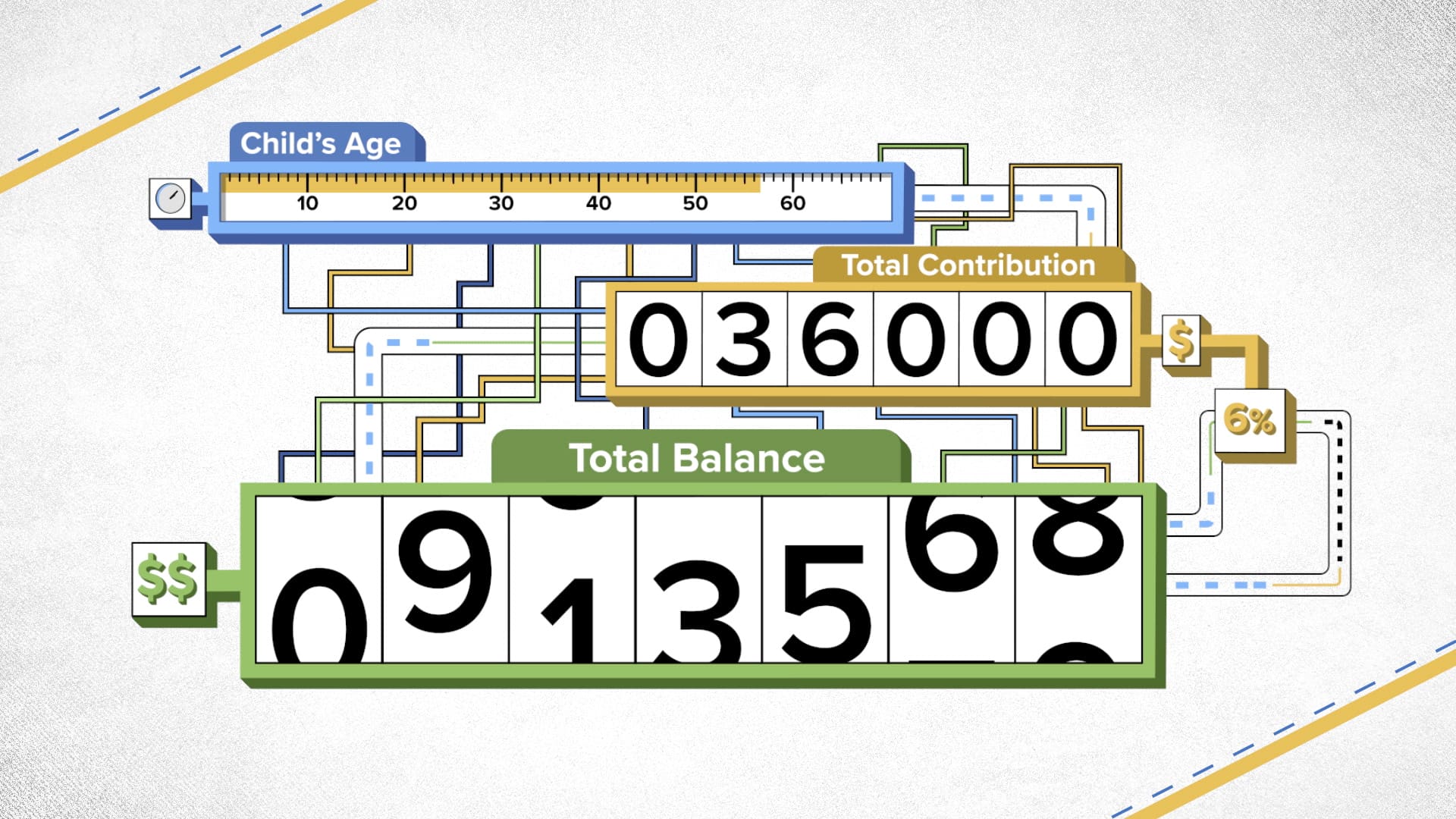

September 26 2021 103 PM. Under the American Rescue Plan eligible families are entitled to monthly payments of up to 300 for each child 5 and under and up to 250 for each child 6 to 17. Payments began in July and will continue through.

The Internal Revenue Service said a technical issue is to blame for some people not receiving the September installment of the child tax credit. Some eligible parents who are missing their September child tax credit payments should get them soon. The third payment went out on September 17 We apologize The IRS said.

We know people depend on receiving these payments on time and we apologize for the delay. This means that each advance payment will be worth either 250 or 300 per child for parents jointly making less than 150000 per year or single parents making less. The expanded child tax credit pays up to 300 per child ages 5 and younger and up to 300 for children ages 6-17.

Change language content. Did not receive the money. Per the IRS the typical overpayment was 3125.

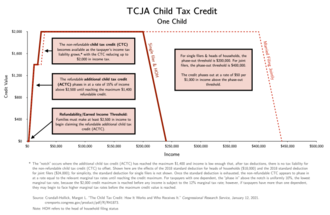

The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. The good news is that in most cases the overpayments arent going to make a huge dent in the Child Tax Credit checks. Though the Internal Revenue Service sent out the third monthly child tax credit payment last week some families are still waiting for the funds.

The expanded child tax credit pays up to 300 per child 5 and under and up to 300 for children 6 to 17. This year also marks the first time that part of the child tax credit has been sent as direct. The payments are scheduled to arrive on the 15th of each month so the September payment was supposed to arrive in bank accounts or be mailed out to tens of.

Eligible families who do not opt-out will receive 300 monthly for each child under 6. Using CNETs child tax credit calculator you can. Each of these amounts would be divided into six monthly payments What if you received more or less than you anticipated.

Payments began in July and will continue through December with the. The enhanced credits are an increase from the 2000 per child tax credit in 2020. Some 35 million child tax credits worth 15.

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Some Parents Haven T Received The September Child Tax Credit Payment

The American Families Plan Too Many Tax Credits For Children

What Is The Child Tax Credit And How Much Of It Is Refundable

Some Parents Haven T Received The September Child Tax Credit Payment

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy

Child Tax Credit United States Wikipedia

American Rescue Plan 2021 Tax Credit Stimulus Check Rules

Biden Administration Reups Child Tax Credit Portal Politico

How Four Families Used The Child Tax Credit The New York Times

Child Tax Credit Faqs For Your 2021 Tax Return Kiplinger

If My Income Is Less Than Expected This Year I Might Be Eligible For Medicaid What Can I Do To Cover My Bases Healthinsurance Org

What Are Tax Credits Low Incomes Tax Reform Group

Child Tax Credit First Payments Go Out July 15 Fox21online

Child Tax Credit Here S Why Your Payment Is Lower Than You Expected The Washington Post

Child Tax Credit United States Wikipedia

Stimulus Update If Your Child Tax Credit Payment Was Less This Month This Could Be Why

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities